Sequoia Capital: 10 Trillion AI Revolution Reshape Industry

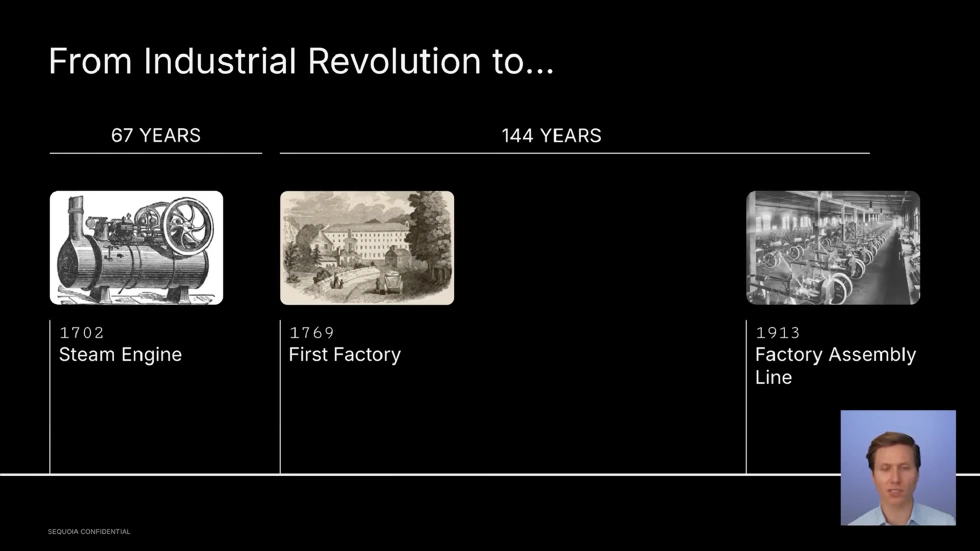

On August 28th, Konstantine Buhler, a partner at Sequoia Capital US, gave a speech titled “The $10 Trillion AI Revolution.” In this speech, Sequoia made two clear assertions. First, the pace of the AI revolution is much faster than that of the Industrial Revolution. The previous Industrial Revolution, from the steam engine to the popularization of electricity, took 144 years. In contrast, today’s AI transformation is being compressed into just a few years. Buhler stressed that AI has already moved from the laboratory to the forefront of industry, representing not just a technological cycle but a $10 trillion opportunity.

On August 28th, Konstantine Buhler, a partner at Sequoia Capital US, gave a speech titled “The $10 Trillion AI Revolution.” In this speech, Sequoia made two clear assertions. First, the pace of the AI revolution is much faster than that of the Industrial Revolution. The previous Industrial Revolution, from the steam engine to the popularization of electricity, took 144 years. In contrast, today’s AI transformation is being compressed into just a few years. Buhler stressed that AI has already moved from the laboratory to the forefront of industry, representing not just a technological cycle but a $10 trillion opportunity.

Second, specialization will become the core logic of the AI revolution. The US service industry has a huge market size, yet only 0.2% has been automated by AI. As capabilities of large models and foundational computing infrastructure leap forward, AI is rapidly penetrating core fields such as finance, healthcare, law, and education, reshaping the production function of knowledge labor.

Today, this new $10 trillion opportunity may no longer belong to traditional giants but to startups that continue to specialize and deepen general-purpose AI technology. Especially in sectors such as services, a new generation of publicly listed companies centered around AI may emerge.

Lessons from the Industrial Revolution

Sequoia deconstructed the Industrial Revolution into three key milestones: the invention of the steam engine, the first-generation factory system that brought production elements under one roof, and the true assembly line. British engineer Thomas Newcomen invented the world’s first practical steam engine. British industrialist Richard Arkwright established the first modern factory system—a textile factory—transitioning production from scattered handicraft workshops to a unified, streamlined factory model. The assembly line, first proposed by Ford Motor Company, gradually evolved into a comprehensive system of standardized machine production. Each worker handled only a part of the assembly, greatly improving efficiency.

However, it’s important to note that these three milestones were not realized in a linear progression but with long “windows of inactivity.” For instance, there were 67 years between the steam engine and the first factory system. The first factories even operated with water power, not steam. It took another 144 years from the first factory system to the mature assembly line. Why did it take so long?

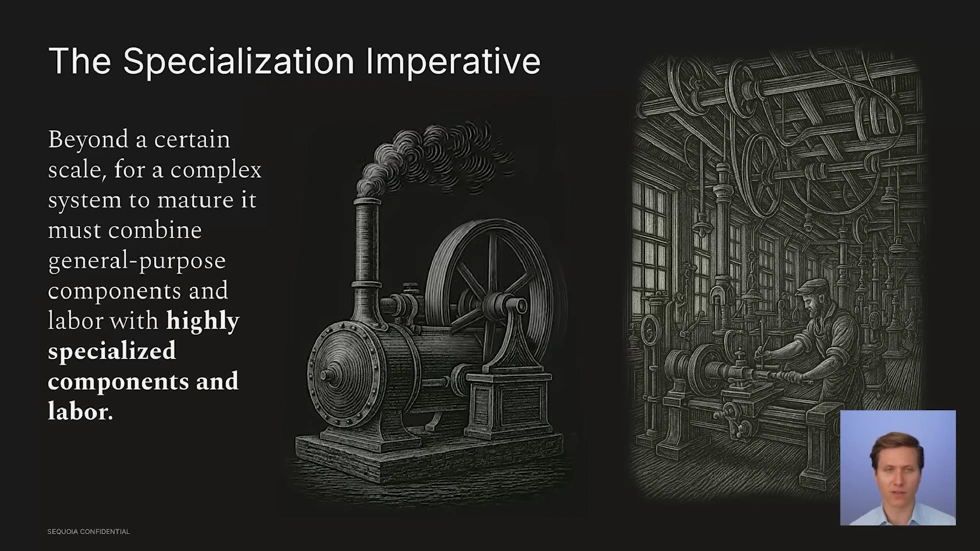

Sequoia’s explanation is the inevitability of specialization: once system complexity reaches a threshold, stable output requires continuously breaking down general technology and general labor into specialized components and specialized labor. Just having a steam engine wasn’t enough; it had to be constantly refined and adapted for textile, mining, transport, and other scenarios to become truly efficient.

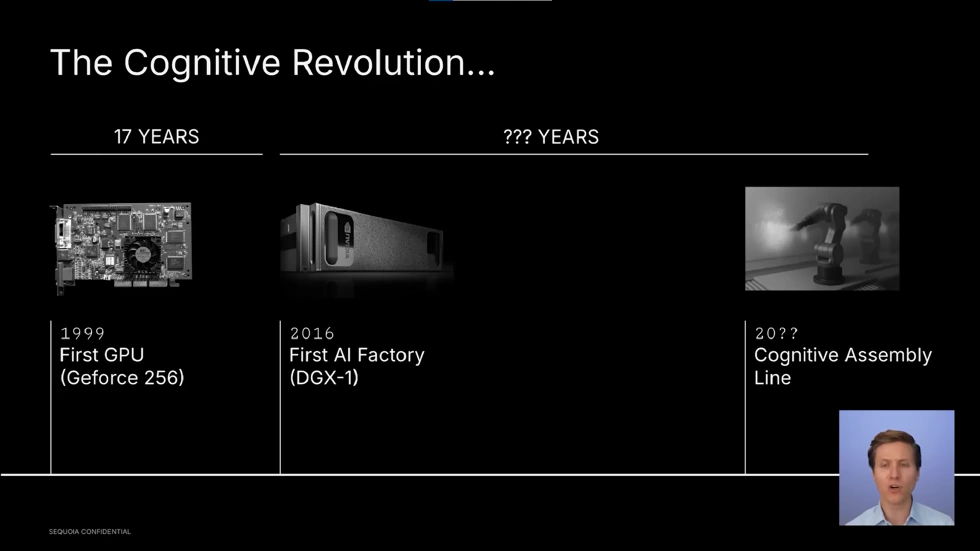

This is why the Industrial Revolution needed over a century to transition from invention to mass social production. However, in the new AI revolution, the underlying conditions have changed. Compute power, algorithms, data, and distribution infrastructure have already been laid down in the internet and cloud computing era. Specialization can now occur much faster at the software, model, and workflow layers.

Why the AI Revolution is Faster

Sequoia uses a comparison to emphasize the degree of time compression. The GPU GeForce 256 from 1999 was like the steam engine, igniting smart computing. In 2016, as deep learning saw an explosion, GPU capabilities, large-scale datasets, and open-source frameworks like TensorFlow and PyTorch matured, forming the first-generation AI factories. Training, inference, data, and distribution—the components of token production—were brought under one roof. Subsequent specialization can now accelerate along dedicated model and application pathways, no longer relying on lengthy physical infrastructure build-outs.

Thus, the question is no longer “when will it arrive,” but “who will accomplish specialization.” Sequoia brings this issue home to startups, believing that the application and infrastructure companies born today and in the next few years will play roles akin to Rockefeller, Carnegie, Westinghouse and other industrial giants in the AI revolution. They will bring general model capabilities into specific jobs and scenarios, creating “repeatable, maintainable, and billable” dedicated production lines.

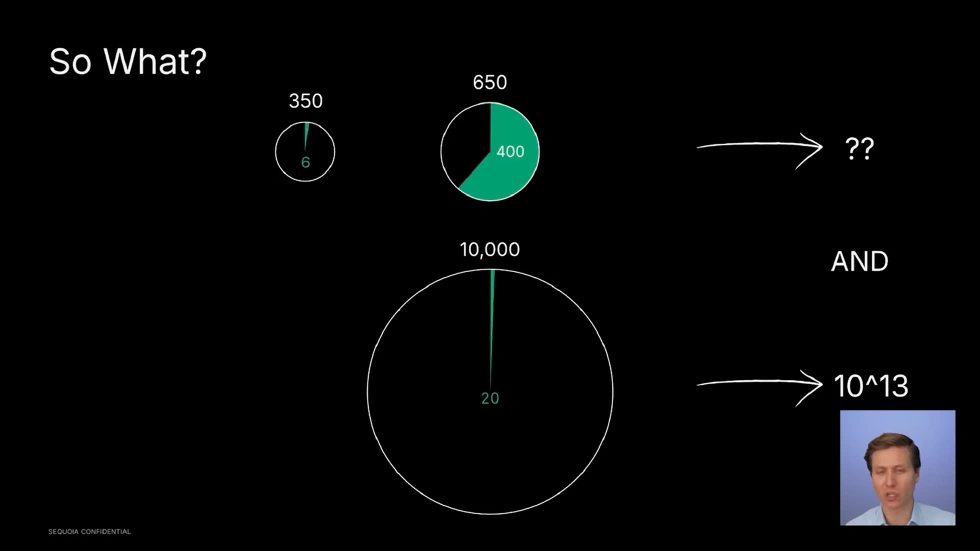

Sequoia uses the cloud era as an analogy to explain the twin effect of “increased share plus expanded total market.” The starting point is a $350 billion enterprise software “total pie,” of which SaaS is a tiny $6 billion slice. SaaS not only grew its share within the software market, but expanded the total “software pie” from $350 billion to $650 billion. Sequoia expects the AI curve to replicate and amplify this pattern, this time targeting the $10 trillion US service industry. Currently, AI automation accounts for only about $2 billion—a negligible proportion. Sequoia calls this an opportunity of 10 to the 13th power, emphasizing that the goal is not just to enlarge the share, but to expand the whole pie.

Mapping the Market Opportunity

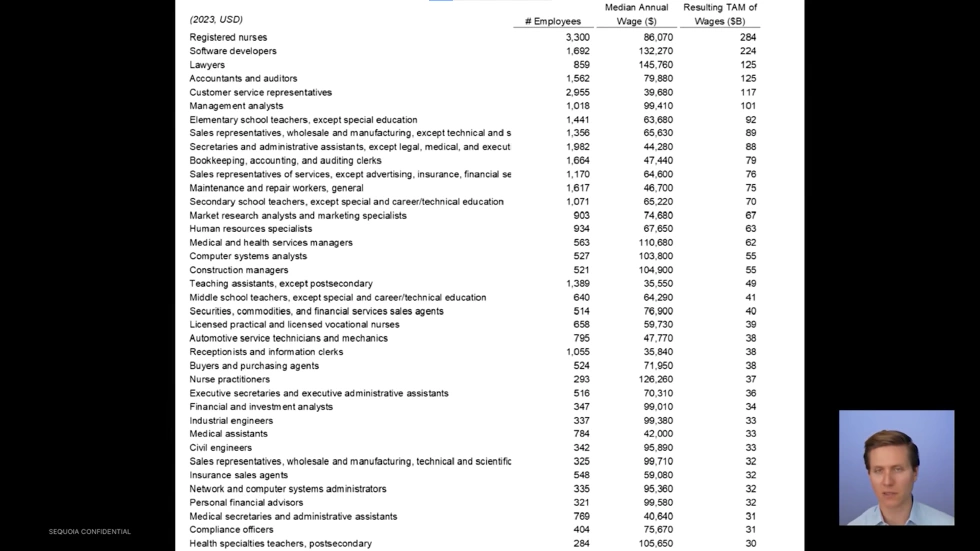

To clarify “where the pie is,” they showed a snippet of an internal memo, sorting job categories by “number of practitioners × median annual salary.” Fields like registered nurses, software development, and legal services are substantial pools of expenditure that technology can fully envelop. Correspondingly, Sequoia has invested along these tracks: OpenEvidence and Freed for nurses, Factory and Reflection for software development, Harvey, Crosby, and Finch for legal services—all targeting the intersection of “jobs × workflow × specialized capabilities.”

This reflects the founding principle of Sequoia’s Don Valentine: first look at how big the pool is, then consider how large a company technology can build from it.

Sequoia then zooms out to the end-game on the secondary market: S&P 500 market capitalization distribution shows “a few giants are swallowing the weights.” Nvidia, to the far left, has surpassed $4 trillion. Yet service organizations like Kirkland & Ellis or Baker Tilly, which generate tens of billions in revenue, don’t appear on the list. Sequoia predicts that the AI revolution will transform service sector businesses, originally driven by people and difficult to scale, into companies powered by models and capable of scaling. Thus, new publicly listed platforms will emerge in market indices, built around AI-driven services.

Five Ongoing Investment Trends

After explaining these contexts, Buhler outlines five ongoing investment trends:

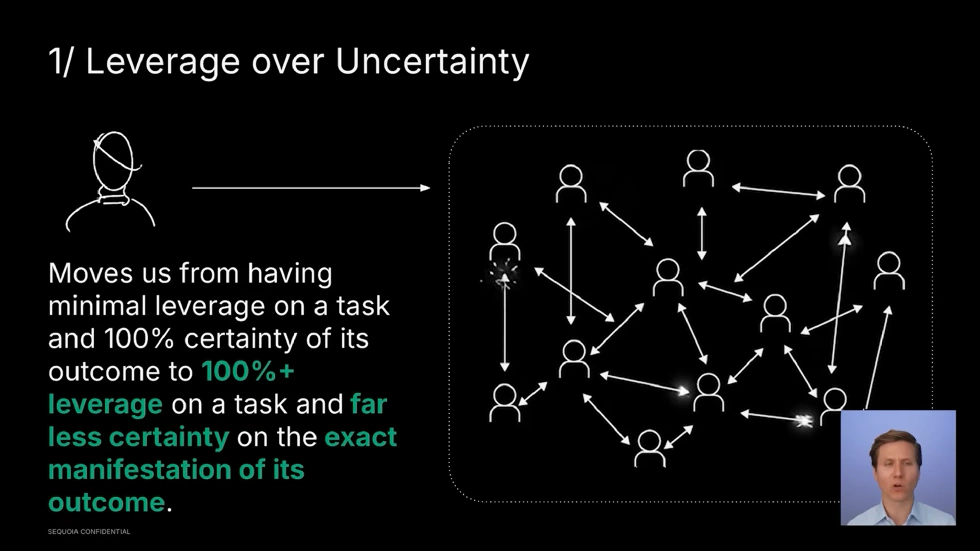

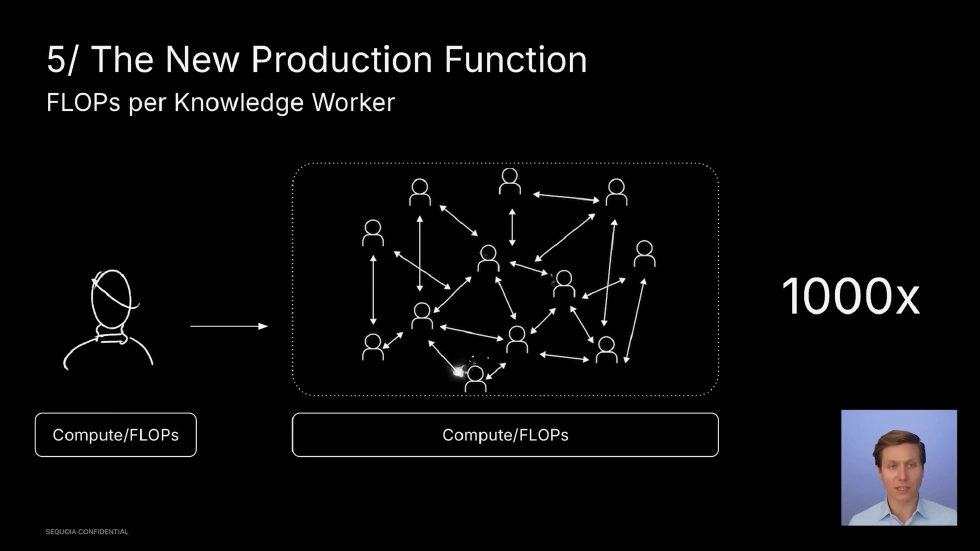

First, Productivity leverage is replacing certainty as the dominant variable. Previously, a sales rep would monitor multiple clients manually. In the Agent future, tools like Rocks can assign each client an AI Agent to track status, flag changes, and prompt re-engagement at optimal times. The human role shifts from “personally participating in every step” to “sampling, correction, and strategy.” Individual leverage rises 100x or even 1000x, though at the cost of less certainty in specific outcomes, which can now be monitored and corrected.

Second, AI benchmarks will enter the real world. Historically, industry progress was measured by academic benchmarks like ImageNet. Now, real-world task performance is paramount. Sequoia cites Expo, which doesn’t compete for leaderboard rankings in papers, but goes head-to-head with hackers worldwide on HackerOne, winning in real data, true opponents, and genuine feedback—showing that success in the real world is the new gold standard.

Third, Reinforcement learning moves from theory to practice. Despite being a research hotspot for years, reinforcement learning stayed mostly conceptual. The past year marked a turning point, as it began to scale practically. Both large inference labs and vertical application firms now use reinforcement learning for ongoing optimization cycles. Sequoia mentions Reflection’s open-source model training as an example, showing how reinforcement learning achieves closed loops of goal, feedback, and improvement, driving more refined specialization.

Fourth, AI enters the physical world—not just humanoid robots, but also manufacturing. Nominal, for example, uses AI to optimize hardware production and quality control at the device edge, embedding “AI productivity” in physical production lines and compressing the design-to-mass-production cycle.

Fifth, Compute becomes the new production function. If the old production function was “capital + labor,” it’s now “compute × knowledge workers.” The metric is FLOPs consumed per knowledge worker. Sequoia’s portfolio expects at least a 10x increase in compute consumption per worker, with optimistic scenarios showing thousands-fold growth. When one person can direct tens, hundreds, or thousands of agents, inference, protection, and application-side companies will benefit.

Key Investment Directions for the Next 12–18 Months

Looking ahead to the next 12–18 months, Sequoia highlights investment directions:

First, persistent memory. Two dimensions: long-term memory that can reliably store and recall context over time; persistent identity, allowing an Agent’s style, preferences, and habits to remain consistent. Sequoia believes this is the key to deeper AI productivity adoption, but there is not yet a clear scaling pathway. Vector databases, RAG, and ultra-long context windows are interim solutions. Truly scalable memory is yet to break through—a huge opportunity awaits.

Second, seamless communication protocols. Recent interest in MCP has proven the demand, but Sequoia likens it to the TCP/IP protocol of the internet—it’s a starting point, not an endpoint. When Agents can reliably interact and invoke one another, cross-system process automation will spawn platform-grade applications. For example, letting AI autonomously handle product search, price comparison, and ordering, eliminates platform monopolies built on user experience moats.

Third, the immediacy of AI voice. Sequoia believes video may take another year to truly mature, but AI voice is already usable and scalable—audio fidelity is high, and latency is low. This applies to consumer scenarios like socializing, companionship, or mental health, and business settings like logistics dispatch or financial quoting, where collaboration still relies on voice. AI can significantly improve accuracy and efficiency.

Fourth, the full-chain opportunity in AI safety—from R&D to distribution integrity, to safeguarding users against misguidance risks, safety is crucial. Sequoia even envisions each human, and every Agent, protected by multiple AI Safety Agents in the digital world—unconstrained by physical space or equal costs.

Fifth, a critical moment for open source. Two years ago, open source looked ready to match and even surpass closed models at the cutting edge. Today, confidence has waned, and open source feels more fragile. Nevertheless, Sequoia insists on the necessity of open source, as a freer, more open future depends on it staying competitive. Everyone should be able to use powerful models to build great products, not leave the field only to a handful of ultra-expensive players.

Conclusion

That covers the main content of Sequoia’s speech. Overall, what comes through is Sequoia’s aim to emphasize the temporal difference between this AI revolution and previous industrial revolutions. They believe that, as persistent memory, communication protocols, voice interaction, safety, and open source are tackled one by one, the AI revolution will quickly leap from the factory system to the assembly line stage—compressing decades of progress into a few years and growing the market from less than $1 trillion to $10 trillion.

If Sequoia’s predictions play out, now is the window that startups must seize—perhaps the next batch of publicly listed platform companies will be born here.

References

- The $10 Trillion AI Revolution: Why It’s Bigger Than the Industrial Revolution YouTube. 2025-08-28.

- Facts About The Robber Barons, America’s Captains Of Industry Factinate.

- Don Valentine, Founder of Sequoia Capital, Is Dead at 87 The New York Times. 2019-10-25